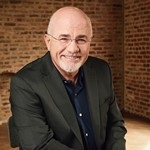

America's trusted voice on money and business, Dave Ramsey is a personal money management expert and extremely popular national radio personality. His three New York Times best-selling books - Financial Peace, More Than Enough and The Total Money Makeover - have sold more than 6 million copies combined. His latest book is EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches. America's trusted voice on money and business, Dave Ramsey is a personal money management expert and extremely popular national radio personality. His three New York Times best-selling books - Financial Peace, More Than Enough and The Total Money Makeover - have sold more than 6 million copies combined. His latest book is EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches.

|

Don’t Be Afraid to Start SmallDear Dave, I’d like to slowly start a business online while working my regular job. But even though I’m in pretty good financial shape, I don’t have much money left at the end of the month. I have no debt except for my house, and I also have nine months of expenses in my emergency fund. How can I start my business without borrowing the money? Kirsten Dear Kirsten, I like where your head is. Start and run your business with cash. Period. Even if it takes a little while to get things off the ground. That should be a guideline for every entrepreneur. But guess what? You may have more money on hand than you think. You’re a little heavy on your emergency fund right now. I recommend people have three to six months of expenses set aside for emergencies. You could back your emergency fund down to six months of expenses, and move the extra over to an account designated for your business. After that, grow it slowly each month until you have enough to open your doors. You’d be surprised how much cash will pile up, even if you save just a little bit at a time. The big thing, Kirsten, is don’t be afraid to start small. Don’t despise humble beginnings. Some of the best and most successful companies in America started as micro-businesses or cottage industries. I literally started my company on a card table in my living room. It’s easier and safer in a lot of ways. So, I love the wisdom you’re showing by wanting to keep your full-time job while starting the business online. So, yeah. Take three or four months of expenses out of your emergency fund, and move it to a designated business account. Watch your budget carefully, and keep spending to a minimum. Above all, don’t take your business into debt. Grow it at the speed of cash. The best, most successful businesses don’t outrun their money and other resources! -Dave Read other business articles |