Chris Crum writes for Small Business Resources about what's new for small business. Chris was a featured writer with the iEntry Network of B2B Publications where hundreds of publications linked to his articles including the Wall Street Journal, USA Today, LA Times and the New York Times. Chris Crum writes for Small Business Resources about what's new for small business. Chris was a featured writer with the iEntry Network of B2B Publications where hundreds of publications linked to his articles including the Wall Street Journal, USA Today, LA Times and the New York Times.

|

NFIB Survey: Small Businesses Welcome Increased Sales and Flexibility in Loan Programs during Current Coronavirus Crisis

A recent survey from the NFIB Research Center revealed that twenty-seven percent of business owners reported experiencing a significant or moderate increase in sales as a result of eased restrictions related to the coronavirus. An additional twenty-seven percent reported a "slight" increase. Forty-two percent reported experiencing no change. A recent survey from the NFIB Research Center revealed that twenty-seven percent of business owners reported experiencing a significant or moderate increase in sales as a result of eased restrictions related to the coronavirus. An additional twenty-seven percent reported a "slight" increase. Forty-two percent reported experiencing no change.

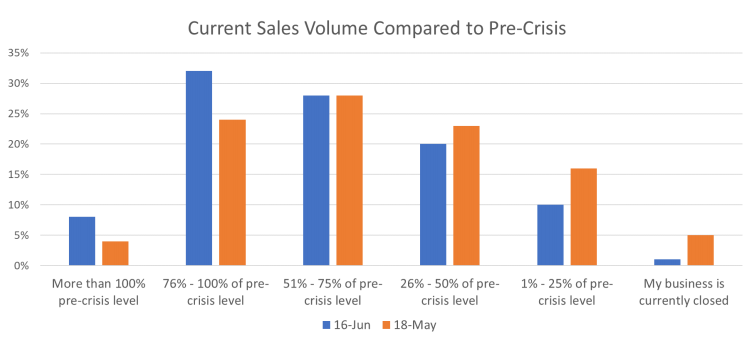

Image via NFIB NFIB Director of Research & Policy Analysis Holly Wade said businesses are still experiencing a "heavy amount of uncertainty and complications" as a result of the economic crisis, but added, "Now that owners have more flexibility in using their PPP loan, they can focus on adjusting business operations accordingly as states loosen business restrictions.” By late June, the survey found that the amount of people applying for PPP loans over the previous month had increased by four percent. Of those who had not applied, only three percent anticipated doing so before the end of the month, which was the original application deadline before it was extended to August 8. Eighty-five percent of those who had applied did so through the bank that they normally use for their business. Ninety-five percent of responding applicants had already received their loans. At that time, only three percent had applied for loan forgiveness. The survey found that fifty-nine percent of PPP loan borrowers are taking advantage of an extended 24-week forgiveness period. Forty percent indicated that they found the new provisions for maximizing loan forgiveness, including allowing more of the loan to go toward non-payroll expenses and the new full-time equivalent employee (FTEE) exemption, "very helpful.” Nineteen percent found these modifications to be "helpful.” One in ten said the original terms were sufficient for their own purposes, and nine percent were not familiar with the recent changes. Fourteen percent of PPP loan borrowers said they still expect to have to lay off employees after using the loan. Half of these businesses expect to lay off one or two people, while 12 percent expect to have to lay off 10 or more. Over a third of business owners who responded had applied for an Economic Injury Disaster Loan. Of those who applied for a PPP loan, an Economic Injury Disaster Loan, or both, nearly half expect that they will need additional financial support over the coming year. Fifty-six percent of business owners surveyed said they will need less than $50K to support business operations in the near term, while twenty-two percent expect they will need over $100K. As the NFIB notes, most small business owners have had to make adjustments to their operations as a result of the coronavirus and the ensuing economic fall-out. The survey confirms this with twenty-three percent indicating the crisis has required "significant" change in operations. Another thirty-two cited "moderate" change. Thirty percent said they have had to modify operations "slightly," while sixteen percent said they have not changed business operations at all. It’s clear that the SBA loan programs have so far been hugely beneficial to small businesses throughout America, but uncertainty looms as the coronavirus continues to impact businesses beyond the initial shutdown period. Talk to your bank about your options if you require financial assistance. Read other business articles |