Chris Crum writes for Small Business Resources about what's new for small business. Chris was a featured writer with the iEntry Network of B2B Publications where hundreds of publications linked to his articles including the Wall Street Journal, USA Today, LA Times and the New York Times. Chris Crum writes for Small Business Resources about what's new for small business. Chris was a featured writer with the iEntry Network of B2B Publications where hundreds of publications linked to his articles including the Wall Street Journal, USA Today, LA Times and the New York Times.

|

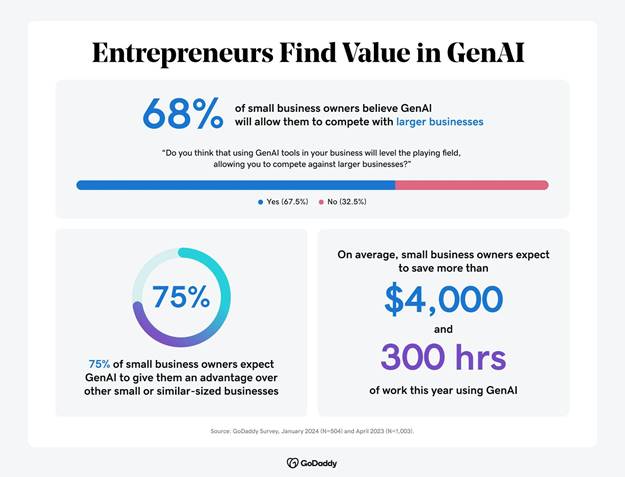

GoDaddy Survey: 75% of Entrepreneurs Believe Generative AI Gives Them an EdgeGoDaddy recently shared research finding that entrepreneurs are quickly adopting generative AI (GenAI) and are increasingly using the technology to run and grow their small businesses. A survey of over 500 small business owners in the United States found that 75 percent believe GenAI will give them a competitive edge over other smaller and similar-sized businesses. Sixty-eight percent believe it will allow them to better compete with larger businesses.

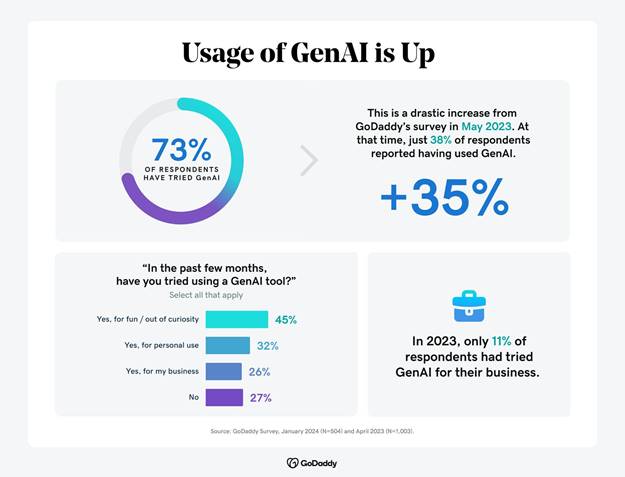

The survey found that 73 percent of small business owners have tried GenAI, with 26 percent of them already using it for business purposes. Last May, when the company conducted an earlier poll, only 38 percent had reported trying the technology. At that time, only 11 percent had tried applying it to their business. Clearly, acceptance is growing quickly in 2024.

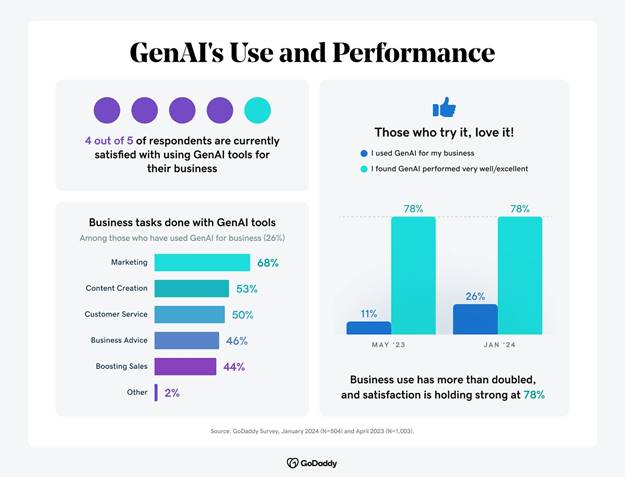

Interestingly, satisfaction with GenAI remained consistent among those who used it across both surveys, with 78 percent claiming to be satisfied both times. This bodes well for the technology as more and more businesses adopt it. The question remains whether satisfaction will remain consistent as usage grows over the coming years.

GenAI provides many opportunities for businesses to experiment, and many are doing just that. Content creation and marketing are the most common uses, but entrepreneurs are also increasingly using GenAI to help boost sales in other ways. In the most recent survey, 44 percent reported doing so, compared to 22 percent in the 2023 poll. Amy Jennette, Senior director of Marketing at GoDaddy, commented, "We’re at the beginning of the AI revolution and small businesses are already taking advantage of the technology, which is really unprecedented. Small businesses usually lag big business in getting the most out of cutting-edge tech, but with easy-to-use GenAI and solutions like GoDaddy Airo, the playing field is finally leveling out." Airo is a set of AI tools which the company announced earlier this year. It lets businesses utilize AI to create logos, websites, social media posts, payment capabilities, and more. While artificial technology in general has raised many concerns among the public and the media, GoDaddy’s survey suggests that small business owners aren’t alarmed, and are embracing what the technology has to offer. Online, one in ten respondents said they believe GenAI could do their job better than they do it. Eighty-nine percent said they are not worried about negative consequences associated with using AI for their business. That number increased from 83 percent in the 2023 poll. GoDaddy says entrepreneurs are feeling optimistic about the future as it pertains to GenAI, with 47 percent indicating they are enthusiastic about their business overall. "Small business owners expect to save more than $4,000 and 300 hours of work this year using generative AI," said Jennette. "The best part about this is we’re at the tip of the iceberg when it comes to what’s possible with GenAI." Businesses of all sizes will no doubt uncover many more uses for the technology as time goes on and GenAI continues to evolve. Read other business articles |